Too Much Information – an online comic

An old house, a geek, a cute transvestite, a very tall lesbian, and at least one ghost–what could happen? – Adult situations and artistic nudity. Not suitable for children.

- Before Commenting

- About TMI

- Web Novel(s)

- Aelfheim

- CHAPTER 1–NAIVETY

- CHAPTER 2–CONFUSION

- CHAPTER 3–FEAR

- CHAPTER 4–COMPASSION

- CHAPTER 5–PASSION

- CHAPTER 6–EFFORT

- CHAPTER 7–DEFIANCE

- CHAPTER 8–RELAXATION

- CHAPTER 9–DECEIT

- CHAPTER 10–DISTRACTION

- CHAPTER 11–CONVERSATION

- CHAPTER 12–DREAM

- CHAPTER 13–FUGUE

- CHAPTER 14–BATTLE

- CHAPTER 15–AFTERMATH

- CHAPTER 16–SOLACE

- INTERMISSION

- CHAPTER 17–RESURGENCE

- CHAPTER 18–REVELATION

- CHAPTER 19–REFRESHMENT

- CHAPTER 20–DISCLOSURE

- CHAPTER 21–DEPARTURE

- CHAPTER 22–MEMORY

- Aelfheim

- Privacy Policy

- Archive

| S | M | T | W | T | F | S |

|---|---|---|---|---|---|---|

| « Oct | ||||||

| 1 | 2 | |||||

| 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 10 | 11 | 12 | 13 | 14 | 15 | 16 |

| 17 | 18 | 19 | 20 | 21 | 22 | 23 |

| 24 | 25 | 26 | 27 | 28 | 29 | 30 |

Control Panel

Blog Categories

Blog Archive

Recent Posts

- ComicPress 2024-10-04

- Tech difficulties 2024-09-23

- What’s stopping me… 2024-04-14

- Andy is doing better 2023-12-18

- I can’t see…?! 2022-09-27

Recent Comments

- Mike Conner on Butch and Sundance on ‘Nip

- Opus the Poet on 2015-12-09

- Bobby on Butch and Sundance

- Opus the Poet on Family Matters

- Alan Cooper on Butch and Sundance on ‘Nip

- Opus the Poet on Family Matters

- anarchduke on ComicPress

- Opus the Poet on 2016-11-28

- Opus the Poet on 2008-01-02

- Hinoron on Butch and Sundance on ‘Nip

- Hinoron on Butch and Sundance

- Hinoron on Butch and Sundance

- Bibliophage on ComicPress

- AndyOH! on ComicPress

- Bibliophage on ComicPress

- Opus the Poet on She Had To Ask

- Rypperdoc on Butch and Sundance on ‘Nip

- Nortog on Butch and Sundance on ‘Nip

- Opus the Poet on Mojo

- Joel Blatt on Butch and Sundance on ‘Nip

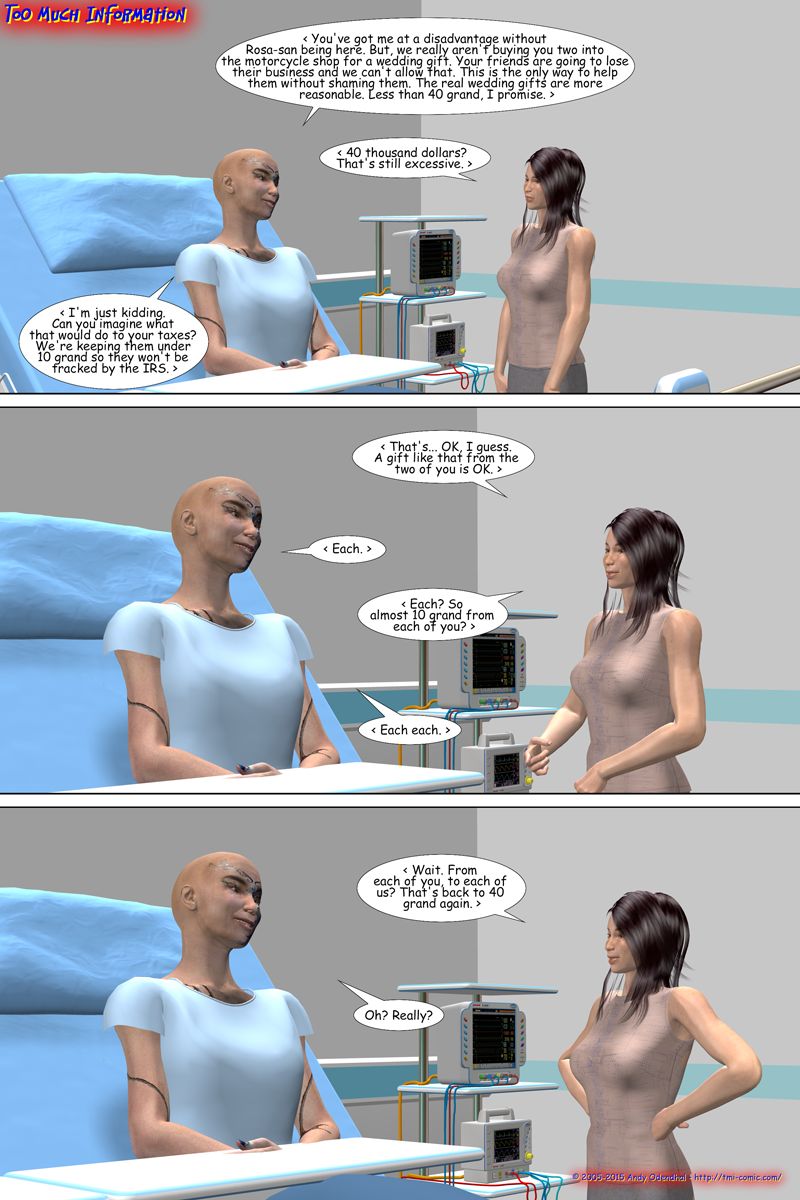

But it won’t bump up your taxes for two reasons. A) the limit for taxes on gifts is $10,000 per year, per person, which means this falls under the limit and won’t trigger taxes. It *will* raise a flag if the money is transferred all at once as the Government notes any transactions over $5000, especially if done in cash. B) the recipient of the gift is not responsible for the taxes , the giver is. Not that the IRS will fail to come after the recipient to collect, but you ar least should have an argument to get your money back. (For the record, I am not a tax attorney and before accepting my statements here as gospel, I strongly recommend you talk to someone trained in *current* tax law. Turkeys change things periodically.)

There may be variations based on location. For instance, MY local tax law has a clause that gifted money over $6000 within a single year must be counted as income (and therefor taxable).

You are correct, I should have specified that I was talking about USA Federal taxes. State Tax law and other countries will be a totally different situation. Another good reason to double check with an expert.